Indian equity markets opened Friday on a cautious note, with major indices showing little movement as investors assessed how Jane Street ban and trade rumors could influence short-term and long-term investment strategies. With global tensions simmering and regulatory crackdowns hitting headlines, traders preferred to stay on the sidelines.

Flat Market Open Reflects Uncertainty

As of 10:17 a.m. IST, the Nifty 50 edged up just 0.04% to 25,415.45, while the BSE Sensex inched higher by 0.05% to 83,274.26. Broader markets, including small- and mid-cap segments, mirrored this flat trajectory, indicating that how Jane Street ban and trade rumors are creating a wait-and-watch sentiment among investors.

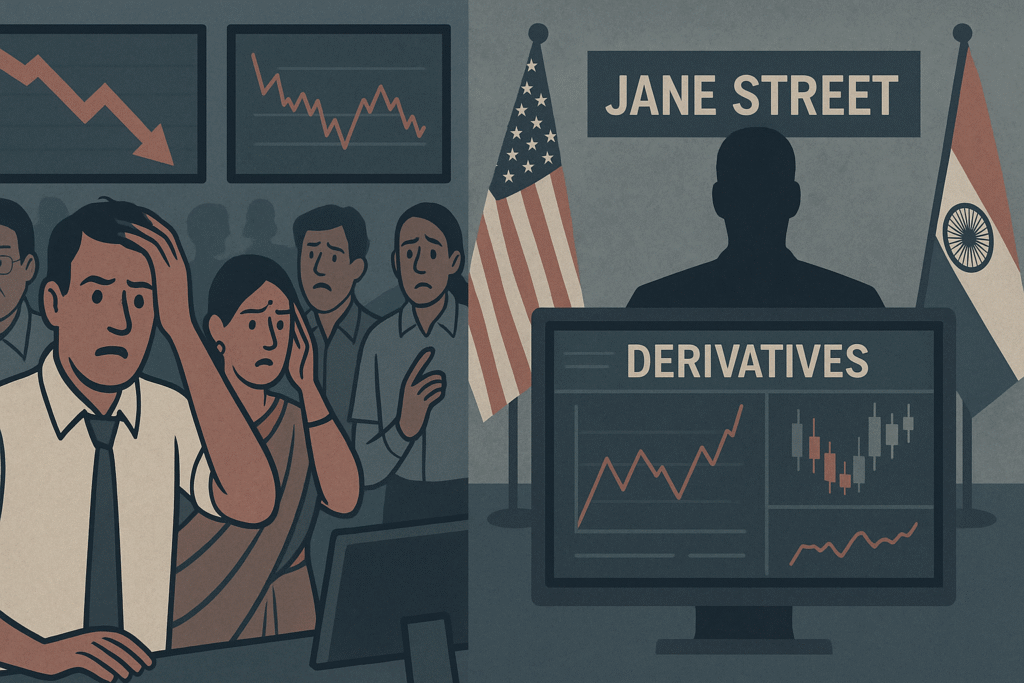

The Securities and Exchange Board of India (SEBI)’s latest interim order against U.S.-based quant trading firm Jane Street has cast a shadow over market confidence. Simultaneously, anticipation is building around a possible India-U.S. trade deal ahead of the July 9 deadline set by President Donald Trump for reciprocal tariffs.

SEBI’s Action: Why It Matters

On Thursday, SEBI issued an interim ban on Jane Street, one of the world’s largest algorithmic trading firms. The regulator accused the firm of manipulating the Indian derivatives market through complex derivative positions over the past three years.

The scale of the case is massive. Four entities linked to Jane Street allegedly made ₹365.02 billion ($4.28 billion) in profits across various National Stock Exchange segments between January 1, 2023, and March 31, 2025. While the probe is still ongoing, the incident raises broader questions about the integrity of automated trading and how Jane Street ban and trade rumors might influence market reforms.

Analyst Views: Specific, Not Systemic

Despite the gravity of the allegations, market experts suggest the fallout may be limited. According to Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, the order is case-specific and “unlikely to trigger a broad foreign investor exit.”

Still, how Jane Street ban and trade rumors are interpreted by institutional investors could determine whether India remains a safe and attractive destination for global capital flows.

Trade Deal Talks: A Looming Catalyst

Beyond regulatory issues, geopolitical factors are also in play. Investors are keenly monitoring developments surrounding a potential India-U.S. trade agreement. The upcoming July 9 deadline set by the U.S. administration adds urgency to ongoing negotiations.

A favorable resolution could remove a key overhang from Indian markets. On the flip side, failure to reach a deal might stoke tariffs and retaliatory measures, thereby escalating uncertainty. This makes how Jane Street ban and trade rumors a dual-headed concern that’s impacting investor psychology across the board.

Market Consolidation After Rally

Vinod Nair, Head of Research at Geojit Investments, noted that domestic equities are entering a consolidation phase following a 15% rally over the past four months. “Investors remain watchful of a potential trade agreement,” he added, underlining how Jane Street ban and trade rumors are reinforcing a short-term consolidation narrative.

The flat momentum reflects this cautious mood. Until clarity emerges on both the regulatory and trade fronts, volatility may persist.

Stock-Specific Movements

Despite the broader market’s subdued tone, a few notable stock moves were observed:

- Bajaj Finance surged 3.1% following a pre-quarter update showing a 25% rise in assets under management. The upbeat numbers provided some relief amid concerns about regulatory tightening.

- Marico gained 3.6% after reporting low-twenties percentage revenue growth for the June quarter, largely fueled by rising rural demand.

- Trent, however, tumbled 7.2% after the fashion retailer posted a sequential decline in June-quarter revenue, underscoring sector-specific challenges.

These mixed results highlight how Jane Street ban and trade rumors are impacting sentiment unevenly across different sectors and business models.

Foreign Investor Confidence on the Line

Foreign institutional investors (FIIs) play a pivotal role in Indian markets. While SEBI’s crackdown might be seen as a sign of regulatory robustness, it could also deter algorithmic trading firms and hedge funds that thrive on complex strategies.

How Jane Street ban and trade rumors are perceived globally may affect India’s standing in the emerging markets universe. Countries with transparent and consistent regulatory frameworks tend to attract more long-term foreign capital.

Sectoral Outlooks: Who’s at Risk?

With how Jane Street ban and trade rumors dominating headlines, specific sectors could see varied impacts:

- Financials may remain resilient, especially as strong pre-quarter updates from firms like Bajaj Finance bolster investor faith.

- Consumer goods could benefit from improving rural demand, as Marico’s results suggest.

- Retail and discretionary sectors, such as Trent, may face pressure due to muted urban spending and seasonality.

Moreover, firms that rely on algorithmic trading or have foreign affiliates may come under regulatory scrutiny, triggering compliance overhauls.

Regulatory Reform Incoming?

The Jane Street episode could serve as a catalyst for broader regulatory changes. SEBI’s actions may pave the way for tighter controls on high-frequency trading and better oversight of foreign entities.

How Jane Street ban and trade rumors evolve could influence SEBI’s future policy roadmap, including changes in margin requirements, surveillance systems, and disclosure norms.

Global Parallels and Market Perception

The global trading community is closely watching the Indian regulator’s actions. Jane Street operates in multiple jurisdictions, and coordinated regulatory scrutiny could follow.

This is why how Jane Street ban and trade rumors transcend domestic headlines — they may have ripple effects on global trading practices and investor behavior.

What’s Next?

With critical trade negotiations ongoing and regulatory investigations underway, Indian markets are navigating through a fog of uncertainty. The next few weeks will be pivotal.

Market participants must now weigh several questions:

- Will the India-U.S. trade deal materialize before July 9?

- Will SEBI’s interim order result in more bans or legal escalations?

- Will global investors recalibrate their India strategy?

Until these uncertainties are resolved, how Jane Street ban and trade rumors will remain central to market movements and policymaker actions.

Conclusion: Stay Cautious, Stay Informed

In conclusion, how Jane Street ban and trade rumors are playing a vital role in shaping the current market narrative. While the broader indices remain largely stable, the undertone of caution is evident. For investors, traders, and policymakers, staying informed and agile is key to navigating these turbulent waters.

Whether these developments translate into long-term structural shifts or short-term noise will depend on regulatory transparency, global diplomacy, and market resilience in the face of uncertainty.