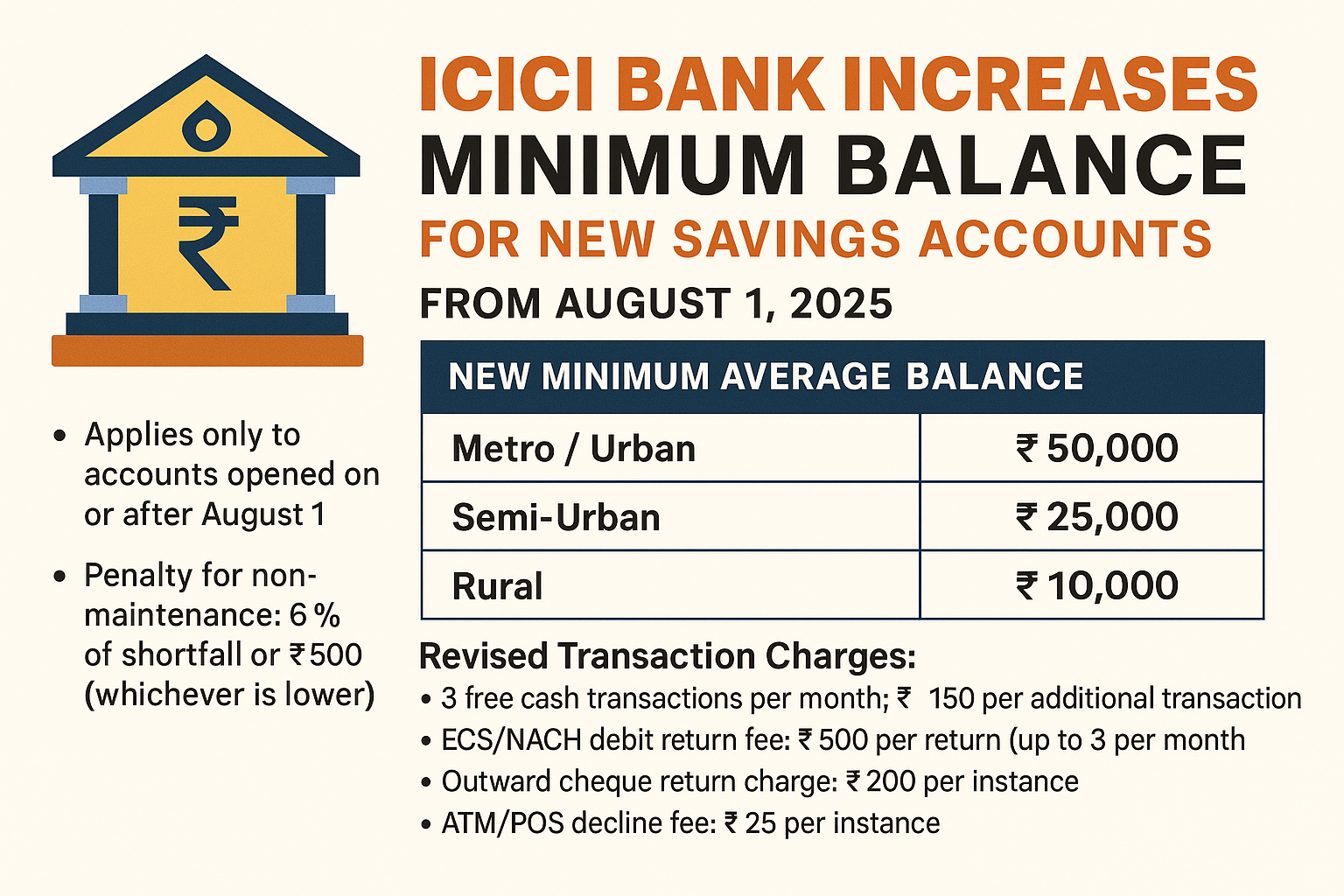

ICICI Bank, one of India’s largest private sector banks, has announced a significant change in its minimum average balance (MAB) rules for new savings accounts. Starting August 1, 2025, new customers opening savings accounts will be required to maintain much higher balances compared to earlier norms.

This move comes with revised transaction fees, penalties for shortfalls, and a sharper focus on encouraging digital banking habits. In this detailed guide, we will break down the new ICICI Bank rules for 2025, the exact minimum balance requirements, penalty structure, and how customers can adapt to avoid charges.

📅 Effective Date of New Rules

The revised MAB norms will come into effect on August 1, 2025.

- Applies To: Only new savings accounts opened on or after this date.

- Existing Customers: Unaffected; they will continue with the previous MAB limits and fee structure.

📊 New Minimum Average Balance Requirements

ICICI Bank has revised its MAB criteria for new accounts across different branch categories:

| Branch Category | Old MAB | New MAB (From Aug 1, 2025) |

| Metro / Urban | ₹10,000 | ₹50,000 |

| Semi-Urban | ₹5,000 | ₹25,000 |

| Rural | ₹2,500 | ₹10,000 |

Key Highlights:

- The metro/urban MAB has increased fivefold to ₹50,000.

- Semi-urban branches see a five-times jump to ₹25,000.

- Rural branch MAB requirements have quadrupled to ₹10,000.

💸 Penalty for Not Maintaining Minimum Balance

If a customer fails to meet the required MAB for their branch category:

- Penalty = 6% of the shortfall amount OR ₹500, whichever is lower.

- Some special customer categories under enrolled programs may be eligible for penalty waivers.

Example:

If your metro account requires ₹50,000 MAB but you maintain only ₹30,000, the shortfall is ₹20,000.

- 6% of ₹20,000 = ₹1,200, but since ₹500 is lower, the penalty charged will be ₹500.

🏦 Revised Transaction Charges

ICICI Bank has also updated several transaction-related fees for new accounts:

- Cash Transactions at Branches or Cash Recycler Machines

- First 3 transactions per month: Free

- Beyond 3: ₹150 per transaction

- ECS/NACH Debit Return

- ₹500 per return, maximum 3 per month per mandate

- Cheque Return Charges

- Outward (customer deposits cheque): ₹200 per instance

- Inward (customer-issued cheque):

- ₹500 for financial reasons (e.g., insufficient funds)

- ₹50 for non-financial reasons (excluding signature verification)

- ATM/POS Transaction Decline Fee

- ₹25 per instance if declined due to insufficient funds

📌 Why ICICI Bank Made These Changes

Banking experts point to several strategic reasons behind the move:

- Encouraging High-Balance Customers

The steep increase in MAB may be aimed at attracting and retaining customers with higher deposits, strengthening the bank’s low-cost funding base. - Promoting Digital Banking

By limiting free cash transactions, the bank nudges customers toward internet banking, mobile apps, and UPI payments. - Reducing Operational Costs

Higher MAB and transaction fees can help offset operational expenses, especially in maintaining branch infrastructure. - Aligning with Industry Trends

Several banks have been gradually increasing MAB requirements in metro cities, and ICICI’s revision is part of this competitive repositioning.

🌏 Impact on Different Customer Segments

1.

Metro/Urban Customers

The leap from ₹10,000 to ₹50,000 MAB could impact salaried individuals with lower monthly income or those who prefer keeping minimal idle balance.

2.

Semi-Urban and Rural Customers

The increase to ₹25,000 and ₹10,000 respectively may put additional pressure on small business owners, farmers, and low-income households.

3.

Digital-Only Customers

Those relying heavily on UPI and online banking may still need to maintain the high MAB but will save on transaction fees by avoiding branch visits.

🛠 How to Avoid Penalties

Here are some practical strategies to avoid MAB penalties under the new ICICI Bank rules:

- Opt for Salary Accounts: These often have zero MAB requirements if your employer credits salary monthly.

- Open Basic Savings Bank Deposit Accounts (BSBDA): These accounts have no MAB requirement but offer limited transactions.

- Maintain Fixed Deposits Linked to Savings Account: In some cases, linked deposits may count toward MAB.

- Consolidate Accounts: Instead of spreading funds across multiple banks, maintain required balance in one primary account.

- Use Auto-Sweep Facilities: This helps keep excess funds in FD while ensuring the MAB requirement is met.

📈 Potential Market Reaction

- Customer Migration: Some customers may shift to banks offering lower MAB or zero-balance accounts.

- Rise in Digital Banking Use: Higher branch transaction costs could drive more adoption of mobile and net banking.

- Increased Cross-Selling Opportunities: ICICI may bundle savings accounts with insurance, investments, or premium services to justify the higher MAB.

🔍 Comparison With Other Banks (2025)

| Bank | Metro/Urban MAB | Semi-Urban MAB | Rural MAB |

| ICICI Bank (new) | ₹50,000 | ₹25,000 | ₹10,000 |

| HDFC Bank | ₹10,000 | ₹5,000 | ₹2,500 |

| Axis Bank | ₹12,000 | ₹5,000 | ₹2,500 |

| SBI (Regular) | ₹3,000 | ₹2,000 | ₹1,000 |

ICICI now leads the private banking sector in terms of MAB requirement for new accounts, far exceeding competitors’ thresholds.

📜 Summary Table of New ICICI Bank Rules (From Aug 1, 2025)

| Category | Details |

| Effective Date | August 1, 2025 |

| Applies To | New savings accounts only |

| Metro/Urban MAB | ₹50,000 |

| Semi-Urban MAB | ₹25,000 |

| Rural MAB | ₹10,000 |

| Penalty for Shortfall | 6% of shortfall or ₹500, whichever lower |

| Free Cash Transactions | 3 per month |

| Cash Transaction Fee Beyond Limit | ₹150 per transaction |

| ECS/NACH Return Fee | ₹500 per return (max 3 per month per mandate) |

| Cheque Return – Outward | ₹200 per instance |

| Cheque Return – Inward (Financial) | ₹500 per instance |

| Cheque Return – Inward (Non-Financial) | ₹50 per instance |

| ATM/POS Decline Fee | ₹25 per instance |

📢 Final Word

The new ICICI Bank minimum balance rules in 2025 represent one of the most aggressive revisions in India’s private banking sector. By raising MAB requirements significantly, the bank is clearly targeting a more premium segment while pushing customers toward digital banking habits.

While existing customers can continue with the old requirements, new account holders will need to assess whether they can maintain these balances consistently to avoid penalties.

If you are considering opening a new ICICI Bank account post-August 1, 2025, weigh the benefits against the higher balance requirements, explore alternative account types, and adopt strategies to minimize transaction fees.