Japanese Market Rally Boosted by Weaker Yen: Export Stocks Surge Ahead of BOJ Decision

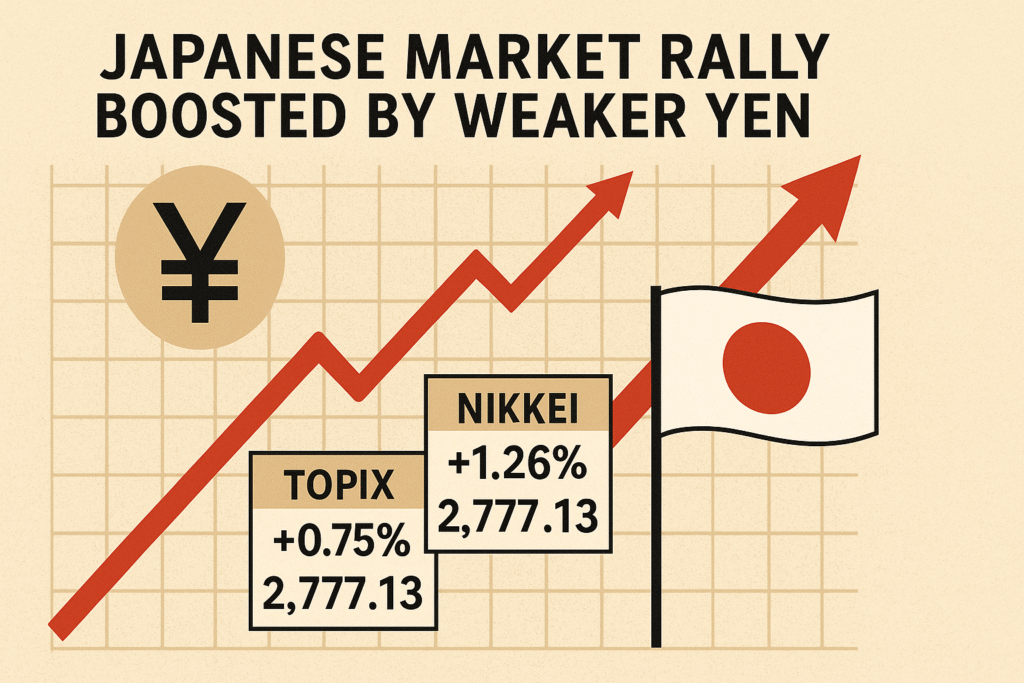

The Japanese market rally boosted by weaker yen continued to gain momentum as investors responded positively to currency movements and optimism ahead of the upcoming Bank of Japan (BOJ) policy meeting. On Monday, the benchmark Nikkei 225 surged 1.26 percent, closing at 38,311.33, while the broader TOPIX index rose 0.75 percent to settle at 2,777.13. This upward momentum highlights how the depreciating yen is fueling confidence in Japan’s export-heavy economy.

Currency Movements Drive Equity Gains

At the core of the Japanese market rally boosted by weaker yen lies a clear trend: the yen’s continued weakness against the U.S. dollar and other major currencies. As the yen depreciates, Japanese products become more competitive abroad, bolstering the outlook for exporters. Companies like Toyota, Sony, and Mitsubishi Heavy Industries all saw their shares climb as global investors bet on improved overseas earnings.

The yen’s value recently dropped to its lowest level in weeks, trading above 157 yen per U.S. dollar. This has made Japanese goods cheaper for foreign buyers, increasing demand and improving profit margins for export-driven corporations. The surge in exports and favorable exchange rates are central drivers behind the Japanese market rally boosted by weaker yen.

Exporters Reap the Benefits

Leading the charge in the Japanese market rally boosted by weaker yen were export-oriented sectors such as automotive, electronics, and industrial machinery. Toyota Motor Corporation saw its stock rise more than 2.3 percent, while Sony gained 1.9 percent. Companies with significant overseas revenue stood out as top performers on the Nikkei and TOPIX indices.

Market analysts point to the favorable foreign exchange environment as a catalyst for increased investor interest in Japanese equities. The expectation that earnings will grow in yen terms, even without substantial sales volume increases, continues to lure institutional and retail investors alike.

BOJ Policy in the Spotlight

Another key factor fueling the Japanese market rally boosted by weaker yen is speculation surrounding the upcoming Bank of Japan policy meeting. Scheduled for later this week, the BOJ meeting is expected to keep interest rates unchanged, maintaining Japan’s ultra-loose monetary policy.

Unlike other global central banks that have aggressively raised rates to combat inflation, the BOJ has largely resisted tightening monetary policy. This divergence in policy has widened the yield gap between Japanese and U.S. bonds, leading to persistent pressure on the yen.

Investors anticipate that the BOJ will continue to support economic recovery by maintaining accommodative conditions. That expectation has encouraged further buying, adding more fuel to the Japanese market rally boosted by weaker yen.

Foreign Investment Flows In

The Japanese market rally boosted by weaker yen has also drawn attention from foreign investors, who are taking advantage of the currency discrepancy to scoop up Japanese assets at a discount. The Japan Exchange Group (JPX) recently reported an increase in foreign buying of Japanese stocks, particularly in sectors that stand to gain from a weaker currency.

Foreign capital inflow has added depth and volume to the rally, further pushing the Nikkei and TOPIX indices higher. Currency-hedged international funds are among the top drivers of demand, with many asset managers seeing Japan as a safe haven amid global economic uncertainty.

Comparisons With Global Markets

While global equity markets remain volatile due to inflation, interest rate hikes, and geopolitical tensions, Japan’s relative stability is attracting increased investor interest. The Japanese market rally boosted by weaker yen stands in contrast to the more turbulent U.S. and European markets.

The BOJ’s dovish stance and the yen’s decline have created a unique investment climate where local equities benefit from a weak currency, unlike in other economies where currency depreciation is often associated with inflationary pressures.

Sectoral Highlights

Besides exporters, several other sectors played a role in the Japanese market rally boosted by weaker yen:

- Technology: Tech firms, particularly chipmakers and robotics companies, posted strong gains. This was fueled by increased global demand and the advantage of a weaker yen on international contracts.

- Financials: Despite the low interest rate environment, banking stocks saw modest gains as investors bet on future policy normalization.

- Retail and Tourism: Companies in these sectors also benefited, anticipating increased inbound tourism and consumer spending, thanks to the yen’s weakness.

Corporate Earnings Outlook

The upcoming earnings season is expected to reflect the full impact of the yen’s depreciation on corporate profits. Many analysts forecast a surge in earnings for firms that rely heavily on exports, reinforcing the thesis behind the Japanese market rally boosted by weaker yen.

Consensus among analysts suggests that Q2 2025 could see significant beats in earnings estimates, particularly from the automotive and manufacturing sectors. This bullish outlook continues to attract buyers ahead of earnings announcements.

Challenges and Risks

Despite the optimistic tone, the Japanese market rally boosted by weaker yen is not without risks. Prolonged yen weakness could eventually lead to inflationary pressures, particularly in imported goods and energy prices. This could force the BOJ to reconsider its policy stance.

Additionally, geopolitical risks in Asia and uncertainty around global trade could temper enthusiasm. Should U.S. interest rates rise further or the BOJ surprise markets with a hawkish tilt, the current rally could face headwinds.

Investor Sentiment

Retail and institutional investor sentiment remains broadly positive, with many traders seeing dips as buying opportunities. The Nikkei Volatility Index has remained relatively stable, indicating a calm market environment supportive of the Japanese market rally boosted by weaker yen.

Brokerages in Tokyo report an uptick in margin trading activity and increased retail participation, further underscoring confidence in the rally’s sustainability.

Conclusion

The convergence of a weaker yen, supportive monetary policy, and strong exporter performance has created a perfect storm for the current Japanese market rally boosted by weaker yen. As investors await the BOJ’s next move, market sentiment remains optimistic, and the rally shows little sign of slowing.

In the days ahead, all eyes will be on the Bank of Japan and corporate earnings results to validate the bullish narrative. But for now, the evidence is clear: the Japanese market rally boosted by weaker yen is not just a headline—it’s a reality shaping global investor strategy.