Neetu Yoshi IPO Day 1: Subscription Status, GMP, Price Band & Key Details of BSE SME Issue

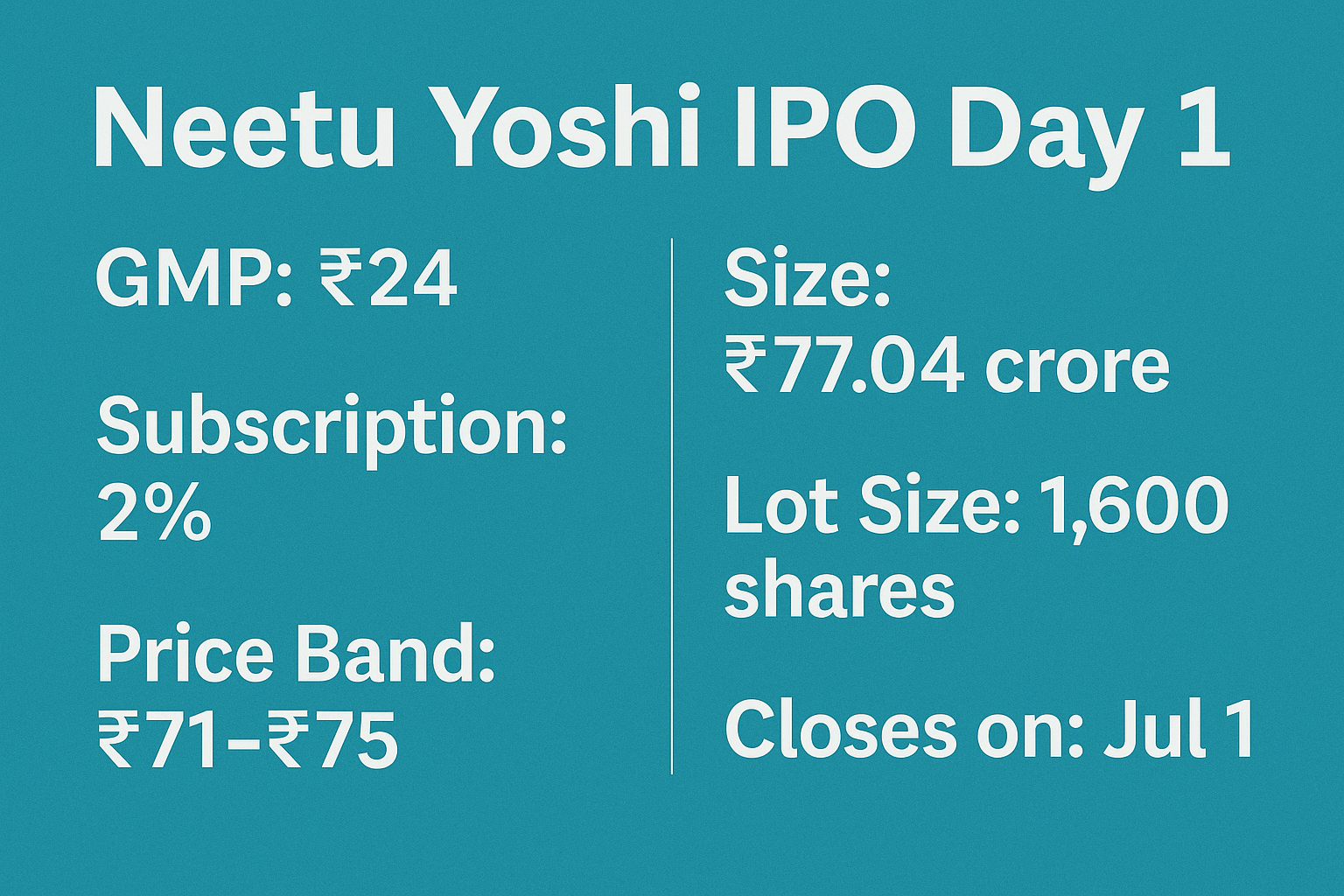

The Neetu Yoshi IPO Day 1 kicked off with notable interest in the SME market, as the customised ferrous metallurgical products manufacturer aims to raise Rs 77.04 crore through a fresh issue of 1,02,72,000 equity shares. Launched on Friday, June 27, the BSE SME IPO is expected to remain open for subscription until Tuesday, July 1.

On Neetu Yoshi IPO Day 1, the issue received an overall subscription of 2% by 10:25 AM. Retail investor participation was slightly higher, with the retail portion subscribed 4%, while non-institutional investors (NIIs) subscribed 3%. The Qualified Institutional Buyer (QIB) segment had yet to see any participation in the early hours.

Grey Market Premium (GMP) Trends

According to market observers, the latest Grey Market Premium (GMP) for the Neetu Yoshi IPO Day 1 stood at Rs 24. This indicates that the shares might list at a premium of nearly 32% over the upper price band of Rs 75. The strong GMP signals healthy investor sentiment and speculative enthusiasm surrounding the offering.

IPO Price Band and Lot Size

The price band for the Neetu Yoshi IPO Day 1 is fixed between Rs 71 and Rs 75 per equity share. Retail investors can bid in lots, with one lot consisting of 1,600 shares. This makes the minimum investment size Rs 1,20,000 at the upper band, making it a high-ticket SME IPO.

Neetu Yoshi IPO Issue Structure

The total size of the IPO is Rs 77.04 crore, entirely through a fresh issue. The shares are allocated as follows:

- QIBs: 48,72,000 shares

- Retail Investors: 34,14,400 shares

- NIIs: 14,65,600 shares

On Neetu Yoshi IPO Day 1, retail and NII segments showed mild participation, while QIBs are expected to come in during the later part of the issue window.

Use of IPO Proceeds

According to the company’s Red Herring Prospectus (RHP), the funds raised through the Neetu Yoshi IPO Day 1 will be utilised for setting up a new manufacturing facility and meeting general corporate expenses. This strategic expansion is expected to enhance the company’s production capacity and market reach.

Company Overview

Neetu Yoshi is a certified RDSO vendor, manufacturing over 25 different casting products for the Indian Railways. It operates as a foundry with an integrated CNC machine shop, providing customised metallurgical products in various grades of mild steel, spheroidal graphite iron, cast iron, and manganese steel. The weight of its finished products ranges from 0.2 kg to 500 kg.

The company’s growth trajectory is impressive:

- FY22: Profit of Rs 7.03 lakh; Revenue of Rs 4.59 crore

- FY23: Profit surged to Rs 42.32 lakh; Revenue rose to Rs 16.23 crore

- FY24: Profit climbed significantly to Rs 12.58 crore; Revenue reached Rs 47.33 crore

- FY25 (up to Dec 31): Profit stood at Rs 12 crore; Revenue already hit Rs 51.36 crore

This financial growth highlights the company’s operational efficiency and scalability, which could be strong factors in the success of the Neetu Yoshi IPO Day 1.

Allotment and Listing Dates

The IPO closes on July 1. As per SEBI’s T+3 listing rules, the Neetu Yoshi IPO Day 1 is expected to follow this timeline:

- Allotment Finalisation: Wednesday, July 2

- Demat Credit/Refunds: Thursday, July 3

- Listing Date: Friday, July 4, on the BSE SME platform

This expedited timeline ensures quicker turnaround for investors, aligning with SEBI’s updated guidelines for SME listings.

Lead Manager and Registrar

Horizon Management Private Limited is the book-running lead manager for the Neetu Yoshi IPO Day 1, while Skyline Financial Services Private Limited is acting as the registrar. Their roles are crucial in overseeing smooth execution, application handling, and share allotment processes.

Market Sentiment and Investment Consideration

The positive GMP on Neetu Yoshi IPO Day 1, combined with the company’s consistent profit and revenue growth, reflects robust investor sentiment. However, investors are advised to consider their risk profile, as SME IPOs can be volatile and are usually suitable for investors with a higher risk appetite.

Market analysts view the Neetu Yoshi IPO Day 1 as an attractive investment opportunity within the SME space, especially given its strong fundamentals, niche manufacturing capabilities, and established clientele like Indian Railways.

Final Thoughts

The Neetu Yoshi IPO Day 1 has opened with cautious optimism in the market. While the subscription figures are modest in the early hours, the strong GMP and company’s growth metrics suggest growing interest as the issue progresses. With a solid foundation in ferrous metallurgical products and a strategic vision for expansion, Neetu Yoshi Limited could emerge as a promising SME player post-listing.

As always, prospective investors should consult certified financial advisors before making any investment decisions. The Neetu Yoshi IPO Day 1 has laid the groundwork for what could be a strong debut in the SME segment, pending broader market dynamics and continued investor interest.