Oswal Pumps IPO 2025 Day 2 Live: Subscription Update, GMP Trends, and Key Investment Insights

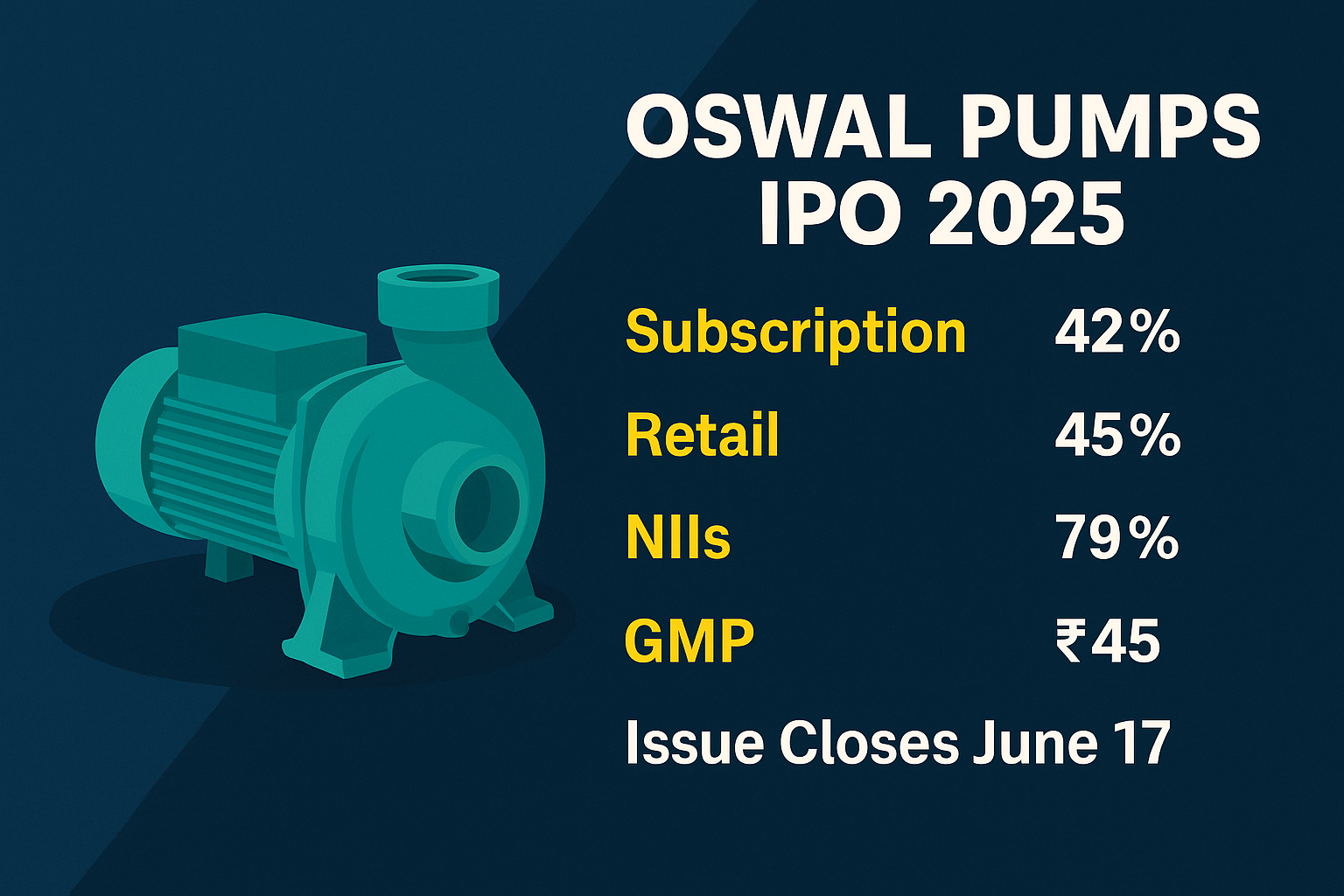

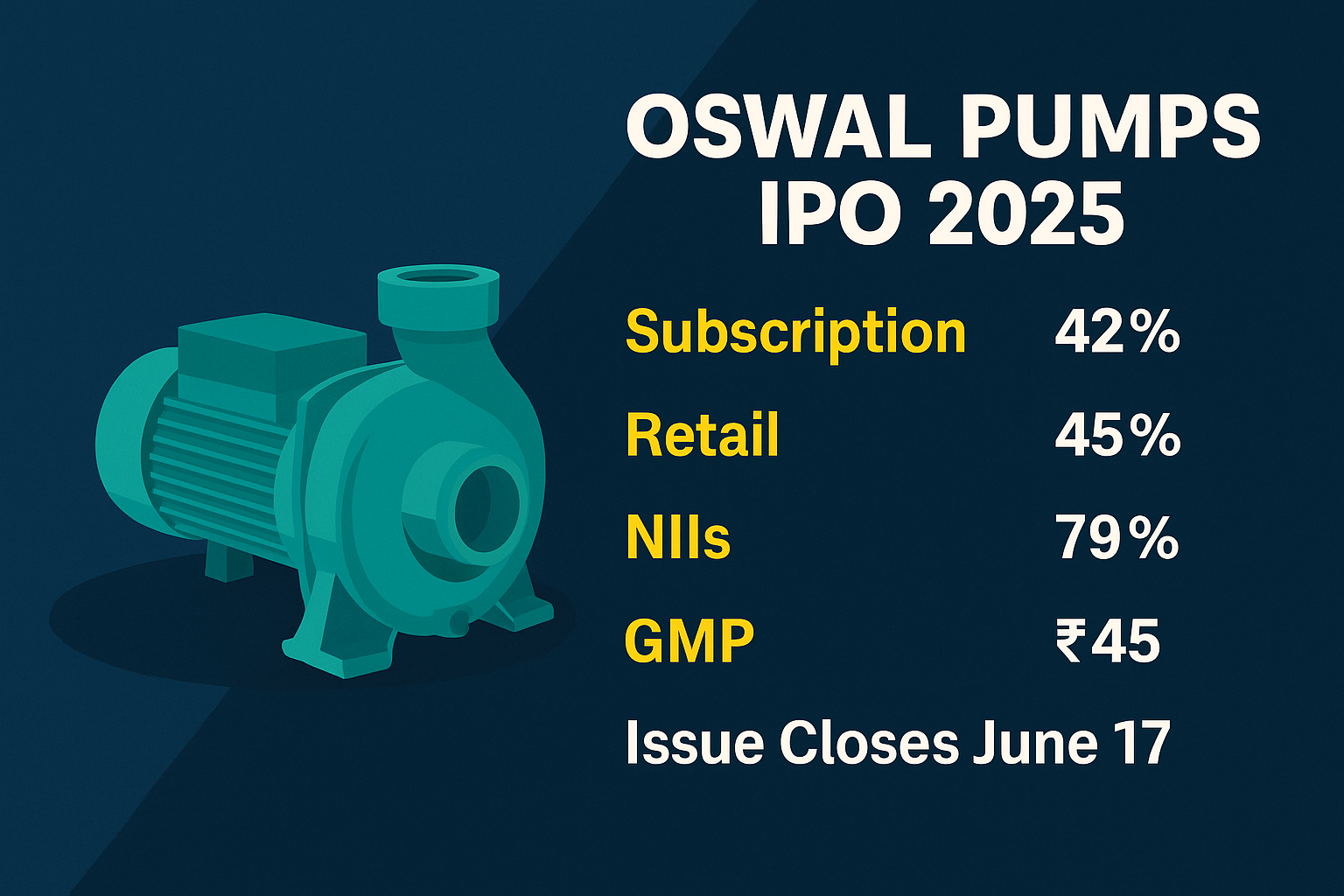

The Oswal Pumps IPO 2025 has entered its second day, drawing growing attention from retail and institutional investors. After launching on June 13, 2025, this much-anticipated public issue will close on June 17. As of the end of Day 1, the IPO saw a subscription rate of 42%, indicating a cautiously optimistic response from the market. Notably, Non-Institutional Investors (NIIs) contributed to a 79% subscription in their category, while the retail portion was subscribed 45%. The Qualified Institutional Buyers (QIBs) segment, however, remained sluggish with only 8% bids.

Let’s explore the full picture of the Oswal Pumps IPO 2025, covering everything from its GMP (Grey Market Premium) and investment rationale to detailed subscription figures and expert recommendations.

Anchor Investor Backing Boosts Confidence in Oswal Pumps IPO 2025

Just before the IPO opened to the public, Oswal Pumps Ltd successfully raised ₹416.2 crore from several marquee anchor investors on June 12. Among these were well-known institutions such as ICICI Prudential Mutual Fund, Kotak Mahindra Mutual Fund, Aditya Birla Sun Life MF, Quant Mutual Fund, Societe Generale, Edelweiss Life Insurance, BNP Paribas, Amundi, and Capital Group. This strong anchor backing provided a boost of credibility and interest around the Oswal Pumps IPO 2025.

Oswal Pumps IPO 2025: Price Band and Lot Size

The Oswal Pumps IPO 2025 is priced between ₹584 and ₹614 per share. Investors can bid for a minimum of 24 shares, and in multiples of 24 thereafter. The total issue size amounts to ₹1,387 crore, which includes a fresh issue worth ₹890 crore and an offer for sale (OFS) of up to 8.1 million shares by promoter Vivek Gupta, who currently holds a 25.17% stake in the company.

Oswal Pumps IPO 2025: Company Background and Strengths

Founded over two decades ago, Oswal Pumps Ltd specializes in solar-powered and grid-connected submersible and monoblock pumps, electric motors including induction and submersible types, and solar modules. All products are marketed under the ‘Oswal’ brand. The company’s vertically integrated manufacturing process gives it a unique edge in terms of quality control and cost management. With a strong foothold in agricultural states such as Haryana and a growing distribution network across India, the firm is well-positioned to tap into rising demand driven by government schemes.

One of the major growth levers for the company is the PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan) scheme. This central government initiative promotes the installation of solar-powered agricultural pumps and offers a significant opportunity for growth in this sector. Oswal Pumps, with its comprehensive product line, is expected to benefit directly from this policy.

Oswal Pumps IPO 2025: Financial Highlights and Growth Metrics

The company has demonstrated robust financial performance over the years. According to Nirmal Bang’s research, Oswal Pumps achieved a CAGR of 44% in revenue, 103% in EBITDA, and 134% in PAT between FY22 and 9MFY25. Furthermore, the company boasts an order book of ₹1,100 crore and an additional bidding pipeline of approximately ₹3,200 crore.

Post-issue, at the upper band of ₹614, the Oswal Pumps IPO 2025 is valued at a P/E ratio of 24.2x and an EV/EBITDA ratio of 16.4x. These valuations are relatively attractive compared to its nearest competitor, Shakti Pumps, making it an appealing option for long-term investors.

Oswal Pumps IPO 2025: Use of Proceeds

The proceeds from the Oswal Pumps IPO 2025 will be utilized across multiple strategic areas:

- ₹89.86 crore will be allocated for capital expenditures to upgrade manufacturing capabilities.

- ₹273 crore will be infused into Oswal Solar, a subsidiary, for setting up a new facility in Haryana.

- ₹280 crore will go towards repayment of existing debts.

- ₹31 crore will be used for clearing debts at Oswal Solar.

These targeted allocations indicate a well-planned growth trajectory and aim to improve the company’s operational capacity and financial stability.

Oswal Pumps IPO 2025: Important Dates

Investors need to be mindful of several key dates related to the Oswal Pumps IPO 2025:

- Issue Closes: June 17, 2025

- Allotment Finalization: June 18, 2025

- Refunds Initiated: June 19, 2025

- Shares Credited to Demat Accounts: June 19, 2025

- Listing on BSE and NSE: June 20, 2025

Oswal Pumps IPO 2025: Subscription Status Snapshot

As per data from the Bombay Stock Exchange (BSE), here’s how the subscription stands:

- Total Shares Offered: 1,62,12,980

- Bids Received (Day 1): 67,83,552

- Overall Subscription: 42%

- Retail Investors: 45%

- NIIs: 79%

- QIBs: 8%

The high participation from NIIs indicates confidence among seasoned investors, while QIB participation is expected to improve closer to the IPO’s closing.

Oswal Pumps IPO 2025 GMP: Current Trend

The current Grey Market Premium (GMP) for the Oswal Pumps IPO 2025 stands at ₹45, indicating strong secondary market interest. At the upper price band of ₹614, the implied listing price based on the GMP is ₹659—suggesting a potential listing gain of around 7.33%.

GMP is an informal indicator of investor sentiment and potential listing performance. Over the past 10 grey market sessions, the GMP for Oswal Pumps has ranged from ₹0 to ₹88, showing an upward trend and signaling strong demand.

Oswal Pumps IPO 2025: Expert Reviews and Ratings

Several brokerages have provided favorable outlooks for the Oswal Pumps IPO 2025:

- Anand Rathi has rated the IPO as “Subscribe-Long Term,” citing strong fundamentals, vertical integration, and favorable government policy alignment.

- Nirmal Bang emphasized the firm’s financial strength, rapid growth in core metrics, and undervaluation compared to peers. They too recommend subscribing.

- Investor Advisory Firms point to the company’s large order book, significant debt reduction plans, and expansion strategy as key positives.

Should You Apply to Oswal Pumps IPO 2025?

For investors seeking exposure to the green energy and agricultural pump sector, the Oswal Pumps IPO 2025 presents a solid opportunity. With its deep product portfolio, aggressive expansion strategy, and focus on clean energy under PM-KUSUM, the company is strategically positioned for long-term growth.

The pricing appears reasonable, and the financial metrics suggest strong earnings potential. Investors with a long-term horizon may find the IPO a valuable addition to their portfolio.

Conclusion

With Day 2 underway, the Oswal Pumps IPO 2025 continues to build momentum. Backed by reputed anchor investors, solid fundamentals, and a strategic growth plan, Oswal Pumps is poised to attract more attention before the issue closes. The Grey Market Premium signals optimism, while expert ratings further bolster confidence in the IPO’s long-term potential.

Whether you’re a retail investor or a seasoned player, keeping an eye on the Oswal Pumps IPO 2025 might just be worth your while.

One thought on “Oswal Pumps IPO 2025: Day 2 Subscription Update, GMP Today, Should You Apply or Skip?”

Comments are closed.