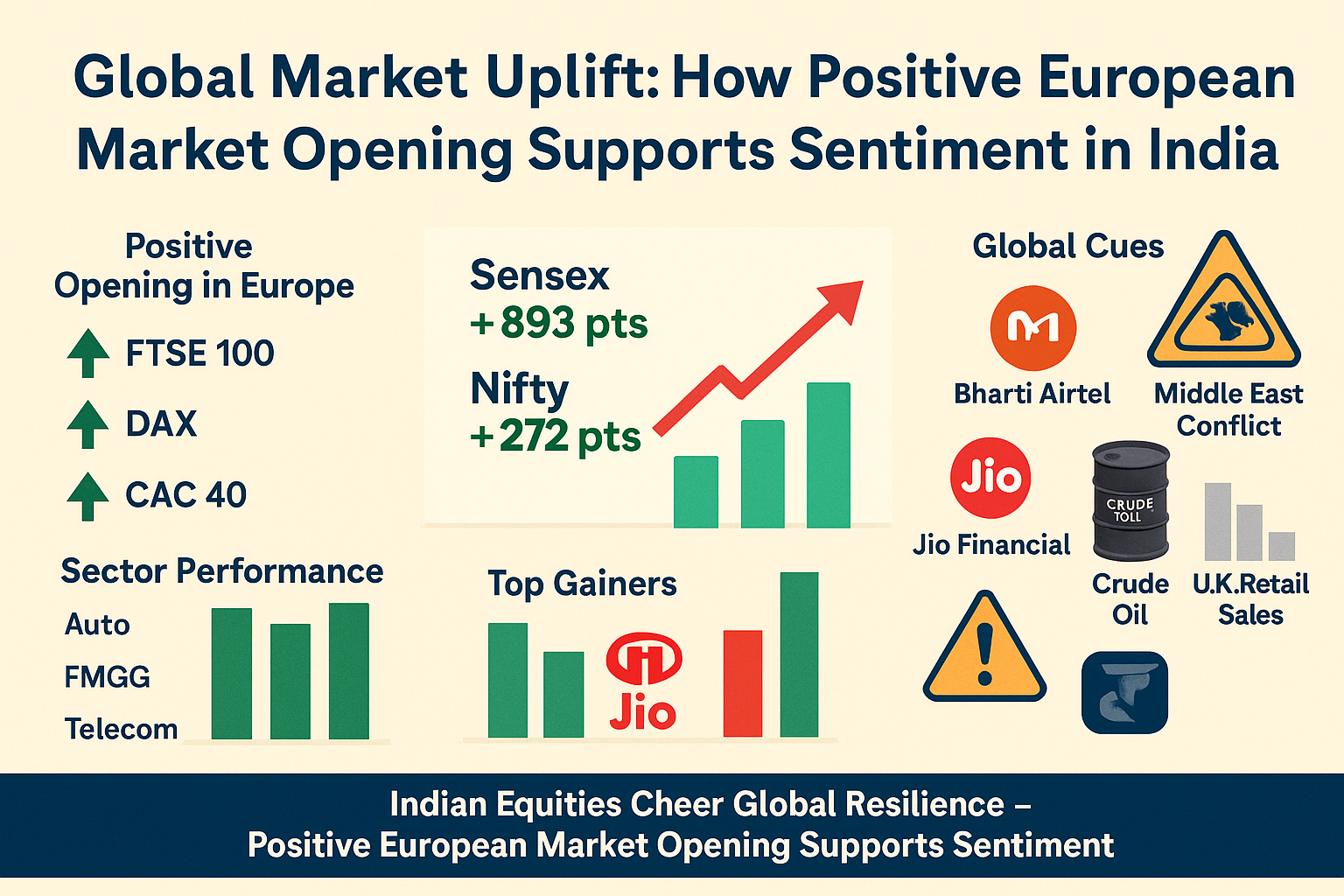

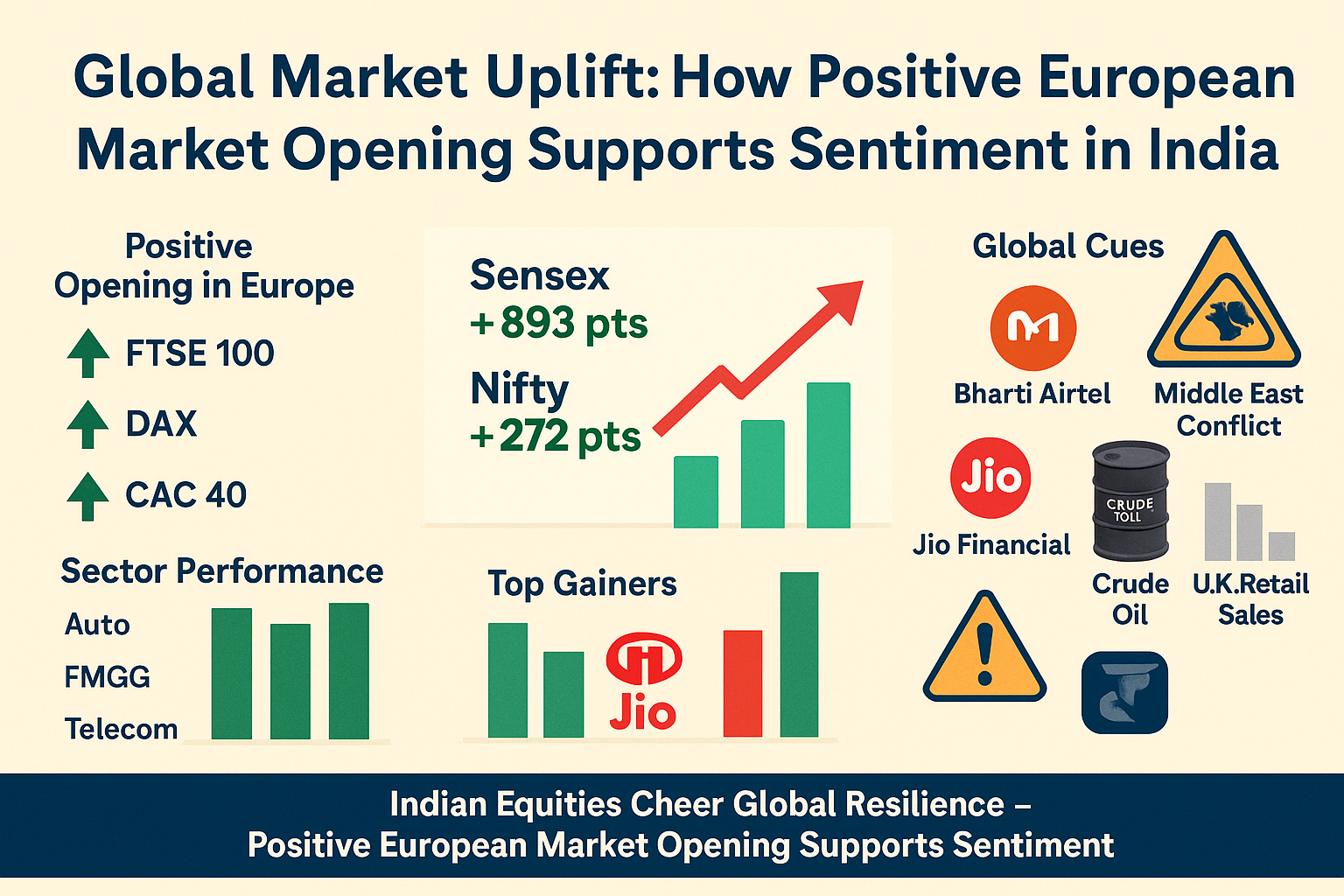

The Indian stock market experienced a robust rally on Friday, showcasing investor optimism amid complex global developments. The uptrend was broadly supported by favorable cues from Europe. In particular, the Positive European Market Opening Supports Sentiment across domestic equities, as investors interpreted global resilience as a green light for selective buying.

Barometers Trade Higher on Global Tailwinds

At 13:30 IST, the domestic equity benchmarks were significantly up, riding on bullish global cues. The S&P BSE Sensex surged 893.22 points or 1.09% to reach 82,251.79, while the Nifty 50 index jumped 271.85 points or 1.10%, crossing the psychological mark of 25,065. The Positive European Marketa Opening Supports Sentiment, giving traders the confidence to take positions in high-quality stocks.

The rally was broad-based, with gains spread across sectors. Apart from the Nifty Media index, all NSE sectoral indices traded in the green. This momentum reflects a deep-rooted belief that Positive European Market Opening Supports Sentiment, despite geopolitical concerns.

Broader Markets Reflect Optimism

Mid and small-cap indices also joined the party. The S&P BSE Mid-Cap index rose 0.87%, and the S&P BSE Small-Cap index added 0.44%. The strong market breadth further validates how the Positive European Market Opening Supports Sentiment, providing tailwinds for stocks beyond blue chips. On the BSE, 2,368 shares advanced while 1,453 declined, indicating solid buying interest across the board.

Nifty50 Gainers and Losers

Among the top Nifty50 gainers were:

- Jio Financial Services: up 2.89%

- HDFC Life Insurance Company: up 2.70%

- Mahindra & Mahindra: up 2.68%

- Bharti Airtel: up 2.45%

- Nestle India: up 1.96%

These gains were largely fueled by the idea that Positive European Market Opening Supports Sentiment, especially in sectors like telecom, FMCG, and auto where global confidence often acts as a catalyst.

On the flip side, Nifty50 losers included:

- Hero MotoCorp: down 1.38%

- Bajaj Finance: down 0.39%

- Dr. Reddy’s Laboratories: down 0.26%

- UltraTech Cement: down 0.13%

- Maruti Suzuki India: down 0.08%

Even the underperformers saw only minor corrections, another sign that Positive European Market Opening Supports Sentiment is cushioning downside risk.

Stocks in the Spotlight

Several individual stocks made headlines, each buoyed by specific developments but also supported by the broader macro theme that Positive European Market Opening Supports Sentiment.

Dilip Buildcon

The company rose 1.40% after securing a ₹1,341 crore order from Konkan Railway Corporation. Infrastructure plays benefit significantly when Positive European Market Opening Supports Sentiment, suggesting continued capital inflow into long-term projects.

Uno Minda

Uno Minda advanced 2.42% on plans to set up a greenfield aluminium die-casting facility in Maharashtra, valued at ₹210 crore. Strategic expansion at this time underscores how the Positive European Market Opening Supports Sentiment inspires confidence in growth investments.

Premier Explosives

Gained 0.96% after securing a ₹6.62 crore defense order from an international client. Defense-related companies tend to thrive when global uncertainty is balanced with strong international sentiment, as Positive European Market Opening Supports Sentiment often ensures.

Suzlon Energy

The renewable energy giant soared 2.98% after bagging its third consecutive order from AMPIN for a 170.1 MW wind project. Green energy is a sector where the Positive European Market Opening Supports Sentiment often translates into institutional interest.

TD Power Systems

Shares rose marginally by 0.14% after securing a ₹67 crore traction motor component order. Even minor gains like this are testimony to how Positive European Market Opening Supports Sentiment can lift sentiment across capex-intensive sectors.

ITD Cementation India

The stock, however, declined 2.79% despite winning ₹960 crore in contracts. The dip could be attributed to profit booking, although the larger context remains supportive as Positive European Market Opening Supports Sentiment persists.

Global Market Trends

European markets opened strongly on Friday. Despite the UK Office for National Statistics reporting a steep 2.7% drop in retail sales in May—the worst since December 2023—investors focused on bigger macro themes. Additionally, UK public borrowing touched £17.7 billion ($23.8 billion) in May, up £700 million from last year.

Still, the Positive European Market Opening Supports Sentiment prevailed, perhaps driven by expectations of rate cuts or renewed stimulus to support retail activity. This bullishness directly spilled over into Indian equities, giving a strong reason for buyers to stay active.

Asian markets mostly traded higher as well, further reinforcing how the Positive European Market Opening Supports Sentiment was part of a global trend. Japan’s core CPI rose 3.7% year-on-year in May, accelerating from April’s 3.5%, while China kept its loan prime rates unchanged—signals of economic stability that support equity risk-taking.

Geopolitical Backdrop

Despite heightened tensions in the Middle East, particularly between Israel and Iran, investors globally seem to be pricing in limited disruption. U.S. President Donald Trump is reportedly contemplating military support for Israel, with a decision expected in two weeks.

The resilience of markets in the face of such volatility underscores how deeply Positive European Market Opening Supports Sentiment is rooted in current investor psychology. Traders appear willing to bet on the continuity of global trade and capital flow even amid potential conflict zones.

Crude Oil and Currency

Crude oil prices remained range-bound, another stabilizing factor for equities. A stable oil market implies that inflationary fears are contained, which complements the narrative that Positive European Market Opening Supports Sentiment and provides a fertile environment for equities.

Meanwhile, the rupee traded in a narrow range against the dollar, indicating no significant risk-off flows, further suggesting that Positive European Market Opening Supports Sentiment is having a calming effect across asset classes.

Conclusion: Optimism Prevails

The Indian equity market’s impressive performance today is clearly linked to broader global cues. With the Positive European Market Opening Supports Sentiment prevailing across regions and sectors, investors are exhibiting renewed risk appetite. This sentiment is especially crucial in the context of lingering geopolitical uncertainties and inflationary pressures.

Investors should continue to track developments in Europe and the Middle East closely. However, if the pattern holds, and the Positive European Market Opening Supports Sentiment continues into next week, further gains across Indian indices may be expected. Whether through large caps, mid-caps, or thematic plays like renewable energy and infrastructure, the prevailing mood is distinctly optimistic.

3 thoughts on “Barometers See Major Gains; Positive European Market Opening Supports Sentiment”

Comments are closed.